November 30, 2022Newsletter

Newsletter 11/2022 IPOs of Investment Vehicles

In 2022, the market environment was difficult for IPOs. Nevertheless, there are interesting opportunities for early strategic realignment and preparation of future listings. Particularly, in the case of investment vehicles, there is continued demand for listed products even in the current environment. This creates opportunities.

1. Introduction The stock market year 2022 was mixed due to the difficult market environment. That is why numerous initial public offerings were postponed this year. Such transactions are complex projects that require sufficient preparation. Therefore, the current market environment can also be seen as an opportunity to shape future plans and assess a company's readiness and positioning before going public. Besides operating companies also investment vehicles can be considered for listing. In the area of investment vehicles, there are numerous opportunities in the current market environment. Thus, this newsletter focuses on the requirements for the listing of investment vehicles.

2. Initial Public Offering a) Term An Initial Public Offering ("IPO") is usually the first listing of a company's shares on the stock exchange. An IPO is one of the most important events in the history of a company. Economically, the IPO means the transition from a privately held corporation to a publicly traded company. Not only stocks of operating companies, but also shares or units of investment vehicles (or certificates) can be listed on the SIX Swiss Exchange ("SIX") or BX Swiss ("BX"). The legal-technical act of listing financial instruments on SIX and BX is regulated in detail in the listing rules of the respective exchange. These requirements are discussed in more detail below. The BX has similar requirements to those of SIX, although certain simplifications exist in some cases.

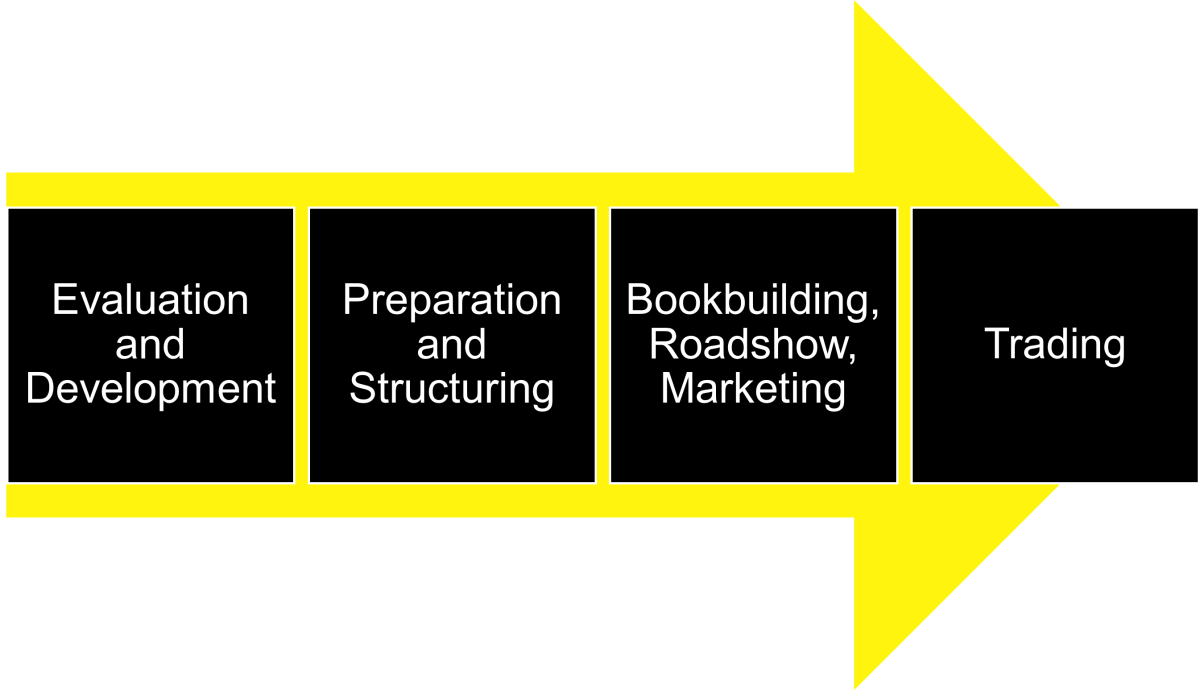

b) Process / Phases The general process of an IPO is shown (highly simplified) in the following diagram:

c) IPO-Readiness Check Whether a company is ready for an IPO can be determined by means of a readiness check. The following questions often arise in this context:

Based on the results of the readiness check, a clean-up may be required. After such a clean-up, the actual transaction is executed. The latter requires compliance with the requirements of the listing rules.

3. General Listing Requirements a) Requirements for the Issuer The Listing Rules of SIX ("LR") contain general requirements for the issuer in Art. 10 et seqq. LR. Such requirements can also be found in Art. 4.1 et seqq. of the Listing Rules of the BX ("LR BX"). The corporate law basis of the issuer must comply with the national law to which the issuer is subject. The issuer must also have existed as a company for at least three years (Art. 11 para. 1 LR). In addition, the issuer must have prepared its financial statements for the three full financial years preceding the listing application in accordance with the accounting standard applicable to that issuer (Art. 12 LR). On the BX, on the other hand, the issuer must only have been in existence for one year (Art. 4.2 LR BX). Exemptions for young companies are governed by the Directive Track Record ("DTR") of SIX or BX. The auditing bodies must meet the requirements of Art. 7 and 8 under the Federal Law on the Licensing and Supervision of Auditors ("RAG"). The auditing body must state in its report whether the issuer's financial statements have been prepared in accordance with the accounting standard applied. The issuer's equity capital must amount to at least CHF 25 million on the first trading day in accordance with the applicable accounting standard (Art. 15 para. 1 LR). If the issuer is a group parent company, the consolidated reported equity capital is decisive. In contrast, lower requirements apply in the new Sparks segment of SIX (i.e., only CHF 12 million equity capital and 15% free float, Art. 89d LR). The reported equity capital on the BX, however, must amount to at least CHF 2 million (Art. 4.6 LR BX).

b) Requirements for Securities The requirements for the securities and the financial instruments to be listed are set out in Art. 17 et seqq. of the LR and in Art. 5.1 et seqq. of the LR BX. The listing of all securities of the same category is required. In particular, a sufficient distribution of financial instruments among the public is deemed to have been achieved if at least 20% of the issuer's securities outstanding in the same category are publicly held (Sparks: 15%) and the capitalization of the publicly held securities amounts to at least CHF 25 million (Sparks: CHF 15 million) (Art. 19 para. 2 LR and Art. 89e LR). On the BX, on the other hand, 15% in public ownership is already sufficient (Art. 5.5.d LR BX).

c) Other Requirements The Listing Rules and additional rules thereto contain further requirements. A FinSA prospectus must be prepared (Art. 27 para. 1 LR; Art. 7.3 LR BX) and a listing application must be submitted (Art. 42 et seqq. LR; Art. 7 et seqq. LR BX). In addition, an official notice must be published (Art. 40a LR; Art. 10 LR BX). The listing application to SIX must be submitted by a recognized representation (i.e., by a bank, a securities firm or a specialized law firm) (Art. 58a LR).

d) Subject to the Special Provisions for Investment Vehicles Special provisions and facilitations for SMEs apply under the regulatory standard Sparks as well as for investment vehicles pursuant to Art. 64 et seqq. LR and under the additional rules (Art. 9a para. 2 LR). We discuss some of these investment vehicles in more detail in section 4 below.

4. Special Requirements for Investment Vehicles a) Real Estate Companies Real estate companies within the meaning of the LR are companies at least two-thirds of whose income is sustainably derived from real estate activities, namely from rental or leasing income, valuation or sales income, and real estate services (Art. 77 para. 1 LR). The distinction between a real estate company and a real estate investment company can often cause difficulties in practice. In the case of a real estate company, the principles of the investment policy must be set out in the articles of association, and the details must be set out in regulations which may be obtained by anyone from the issuer and on its website (Art. 79 para. 1 LR). Art. 11 LR (duration) is not applicable to real estate companies (Art. 78 LR). The Financial Services Act ("FinSA") and the Financial Services Ordinance ("FinSO"), Annex 4, apply to the prospectus.

b) Investment Companies Investment companies within the meaning of the CISA are companies under the Swiss Code of Obligations ("CO") whose exclusive purpose is the collective investment of capital with the generation of income and/or capital gains, without pursuing an entrepreneurial activity (Art. 65 para. 1 LR; Art. 11.1 LR BX). Investment companies in the form of a Swiss stock corporation are not subject to the CISA, inter alia, if they are listed on a Swiss stock exchange (Art. 2 para. 3 CISA). It is noteworthy that the main features of the investment policy of an investment company must be regulated in the articles of association. The details are to be specified in regulations, which can be obtained from the issuer or another office in Switzerland (Art. 67 para. 1 LR; Art. 11.2 LR BX). Art. 11 LR (duration) is not applicable to investment companies (Art. 66 LR). The requirements of the FinSO, Annex 5, apply to the prospectus.

c) Special Purpose Acquisition Companies (SPACs) SPACs as defined by the LR are Swiss stock corporations whose exclusive purpose is the direct or indirect acquisition of an acquisition target or the merger with an operating acquisition target (De-SPAC) and which are dissolved after a max. of three years after the first trading day, provided that no De-SPAC has been completed by then (Art. 89h LR). The regulatory requirements for SPACs are set out in Art. 89h et seqq. LR:

Furthermore, Art. 11 (duration) and Art. 12 LR (annual financial statements) are not applicable to SPACs. In addition, SIX has published a Directive on the Listing of SPACs ("DSPAC"). The requirements for the prospectus are based on the FinSO, Annex 1 and 3.

d) Collective Investment Schemes (incl. ETFs and Real Estate Funds) Collective investment schemes ("CIS") within the meaning of the LR are units or shares of domestic and foreign collective investment schemes which are subject to FINMA supervision pursuant to the CISA or which require FINMA authorization for distribution in or from Switzerland (Art. 105 LR). SIX may issue implementing trading rules for certain types of CIS (e.g., real estate funds, ETFs) (Art. 106 LR). The BX also has its own regulations for collective investment schemes ("CIS Rules"). In addition to the requirement of Art. 19 LR (diversification), CIS must have assets of at least CHF 100 million at the time of listing (Art. 108 para. 1 LR). These requirements may be waived if a market maker is appointed (Art. 108 para. 2 LR). The BX, on the other hand, does not require a minimum issue volume (Art. 5.1 CIS Rules). In addition, an order from FINMA is required (Art. 109 LR). Art. 11 LR (duration) is not applicable to CIS (Art. 107 LR). In contrast, the requirements of the FinSO, Annex 6 for the prospectus must be complied with.

e) Exchange Traded Products (ETPs) ETPs within the meaning of the Additional Rules Exchange Traded Products ("ARETP") of SIX are collateralized, non-interest-paying bearer debt securities (debentures), issued as securities, which are continuously sold and redeemed in the same structure and denomination and track the price performance of an underlying unchanged or leveraged (tracker certificate) (Art. 3 para. 2 ARETP). The BX has also issued additional rules setting out the specific requirements for the listing, maintenance and delisting of ETPs on BX ("ARETP BX"). Exchange Traded Funds ("ETFs") and Exchange Traded Structured Funds ("ETSFs") do not fall under the scope of the ARETP. Unlike ETFs and ETSFs, ETPs are not collective investment schemes within the meaning of the CISA. Unlike most collective investment schemes, ETPs are neither subject to a licensing requirement nor to FINMA supervision. The requirements for the collateralization of ETPs are governed by Art. 14 ARETP (or Art. 6 ARETP BX). ETPs must be collateralized as follows: (1) by contributing the underlying for deposit physically or in the form of a futures contract; or (2) through liquid shares, participation certificates, dividend-right certificates, collective investment schemes, bonds and commodities listed or admitted to trading on SIX or a foreign stock exchange with equivalent regulation; or (3) by cash balances or precious metals. Furthermore, the collateralization must cover at least the outstanding amount of the ETPs. The assets serving as collateral must be held in custody on behalf of the issuer by a third party independent of the issuer. Moreover, the requirements according to FinSO regarding the prospectus must be complied with (Annex 3). In particular, SIX allows cryptocurrencies as underlying assets of ETPs, whereby they must be one of the 15 largest cryptocurrencies in terms of market capitalization in USD (Circular No. 3, para. 5). In the case of BX, on the other hand, it may be one of the 50 largest cryptocurrencies (Art. 7.1.g. in conjunction with Art. 8.3 ARETP BX).

5. Conclusion To sum up, IPOs (of operating companies) were rare this year due to the war in Ukraine and the increase of interest rates. Nevertheless, there is demand for new (listed) investment vehicles in alternative investments (incl. cryptocurrencies) and real estate. However, there are numerous obstacles on the road to IPOs; a structured process is a prerequisite for successful completion. An early readiness assessment is a first step in the right direction even in the current year.

Contacts Luca BianchiTel. +41 58 200 39 56 Fax +41 58 200 39 11 luca.bianchi@kellerhals-carrard.ch  Dr. Dominik OberholzerTel. +41 58 200 39 00 Fax +41 58 200 39 11 dominik.oberholzer@kellerhals-carrard.ch  Dr. Armin KühneTel. +41 58 200 39 00 Fax +41 58 200 39 11 armin.kuehne@kellerhals-carrard.ch  Sarah MostafaTel. +41 58 200 39 00 Fax +41 58 200 39 11 sarah.mostafa@kellerhals-carrard.ch |